Summary

20 slides

Payhawk

Payhawk

Payhawk

Payhawk

Payhawk

20 slides

Introducing Payhawk, the financial system of tomorrow for businesses globally.

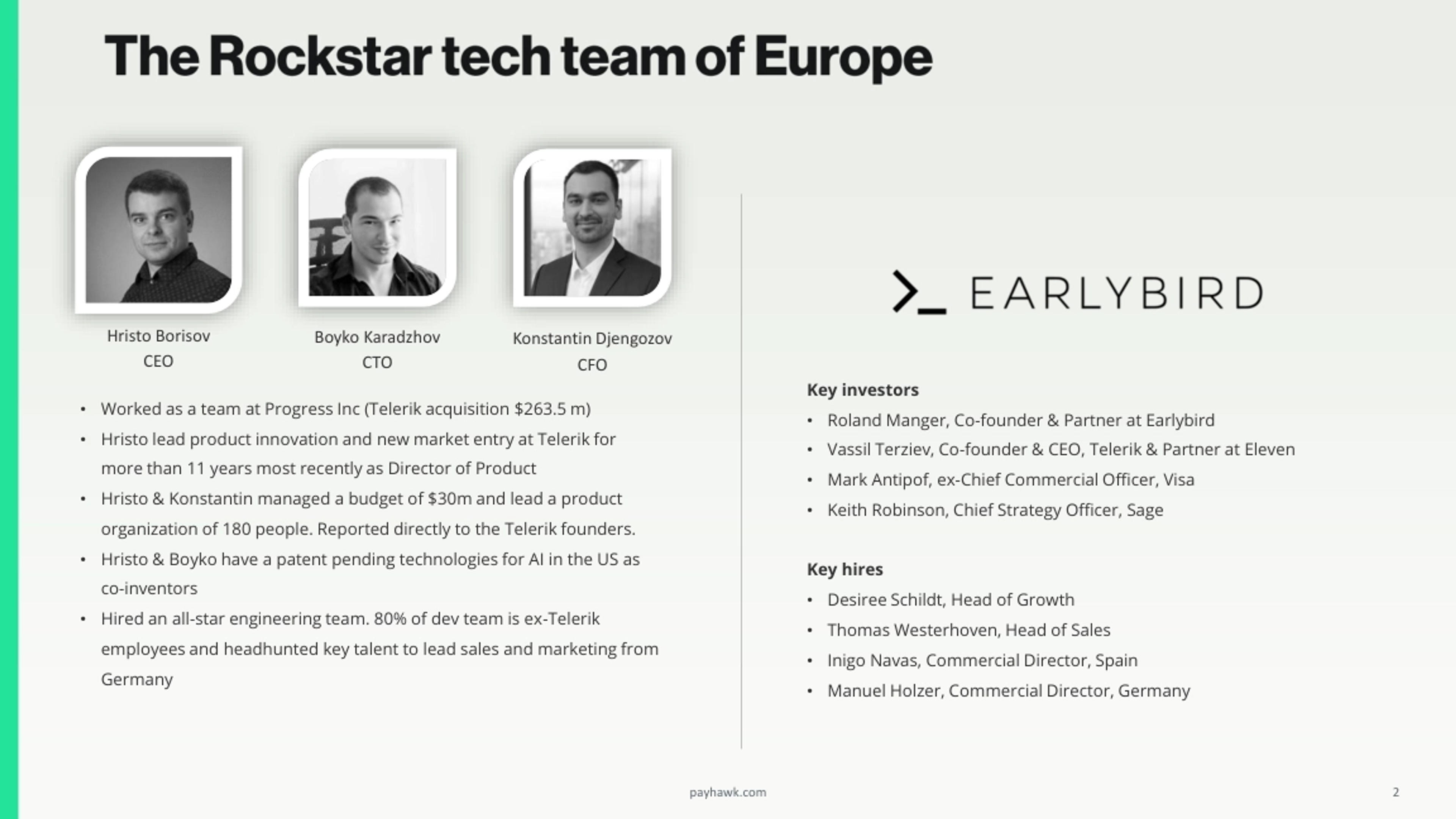

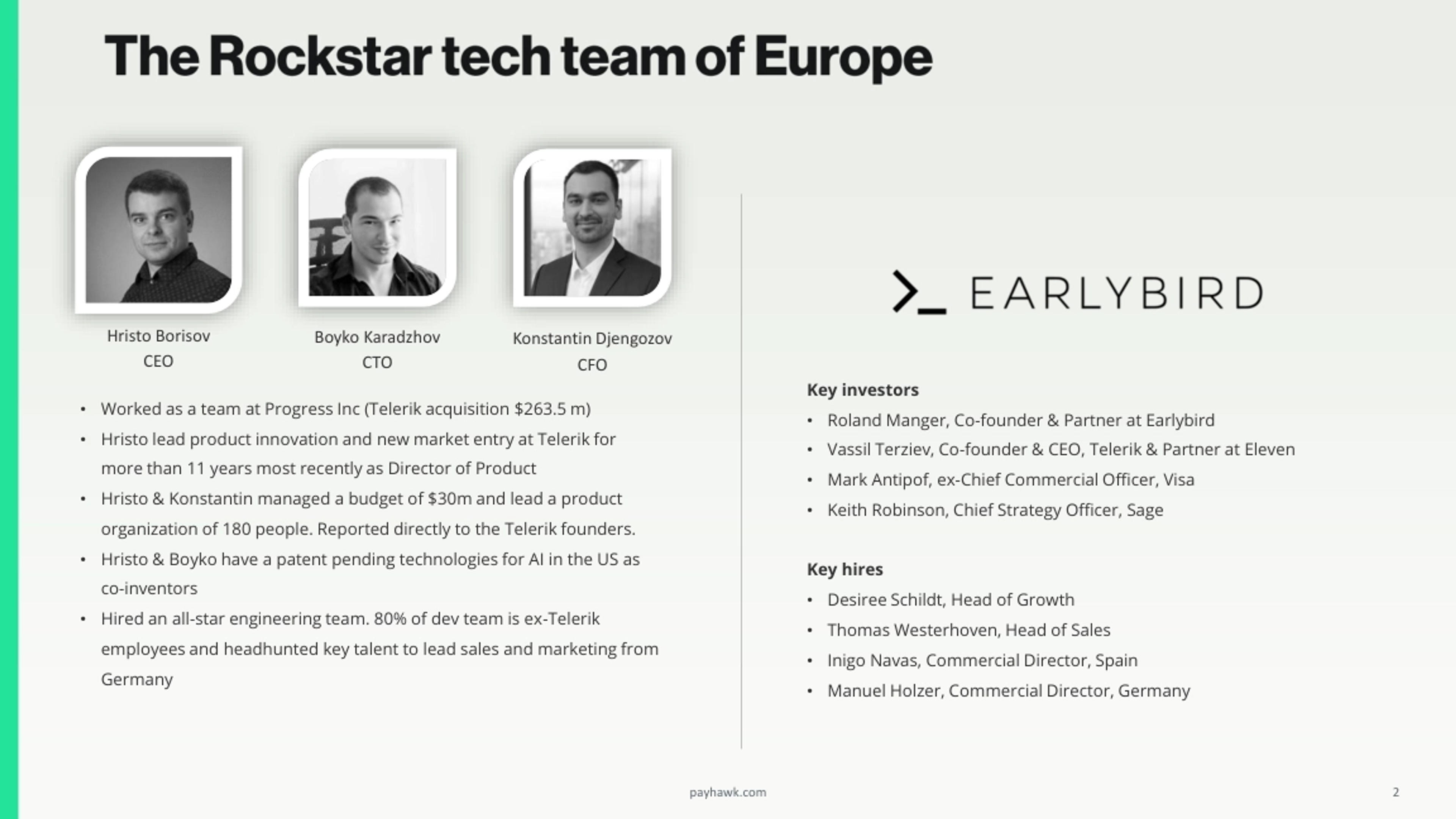

Our leadership team includes seasoned professionals with significant experience and a proven track record in the fin-tech industry, supported by key investors and strategic hires.

Current bank accounts and ERP systems are not designed for seamless business spending management, leading to inefficiencies and slow decision-making within finance teams.

Payhawk is a unified financial system that integrates various functions like payments, expenses, and cash management, providing CFOs with control and visibility over company spend.

Our solution addresses a universal pain across different scales and industries, offering scalable efficiency and control which makes it perfect for high-growth businesses and multinational corporations.

Payhawk leverages the next-gen company cards that cater to the evolving needs of businesses, further setting us apart from competitors by seamlessly integrating additional financial services.

We ensure multiple revenue streams through subscriptions, transaction fees, and service expansions, enabling us to capitalize on vast market opportunities.

Our resilient model and diverse revenue sources have driven substantial growth, with a sustainable path forward even in challenging market conditions, resulting in a highly favorable P&L outlook.

With a universally recognized problem and a superior product, it's an excellent time to push for digital financial transformation, where Payhawk excels.

Payhawk offers seamless integration with traditional banks, meticulous spend control, automation of receipt collections, multi-level approval workflows, and a powerful pre-accounting OCR capable of reading multiple languages.

Thank you for considering Payhawk. Our team is ready to revolutionize business spending management from our various global office locations.

1 slide

1 slide

1 slide

1 slide

3 slides

1 slide

1 slide

2 slides

1 slide

7 slides

1 slide